Operating cash flow is particularly important for investors, who often look at both ocf and net income when deciding to invest or not. A higher level of cash flow indicates a better ability to withstand declines in operating performance, as well as a better ability to pay dividends to investors.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

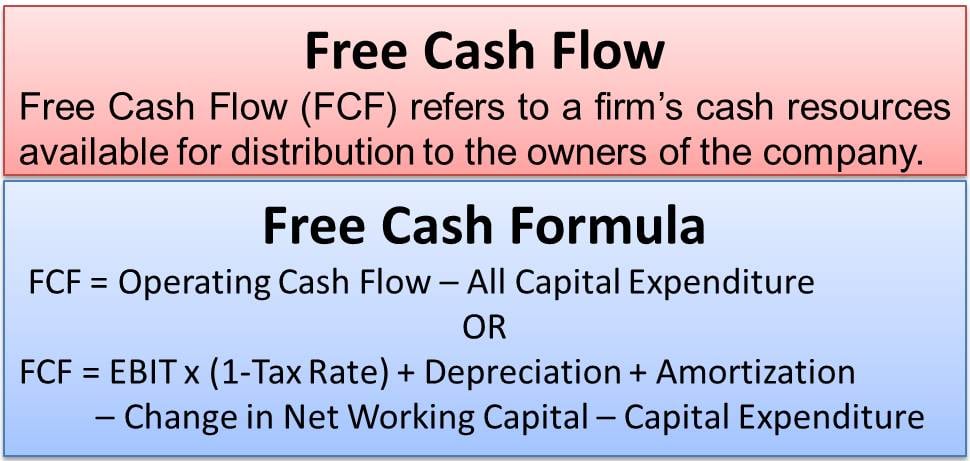

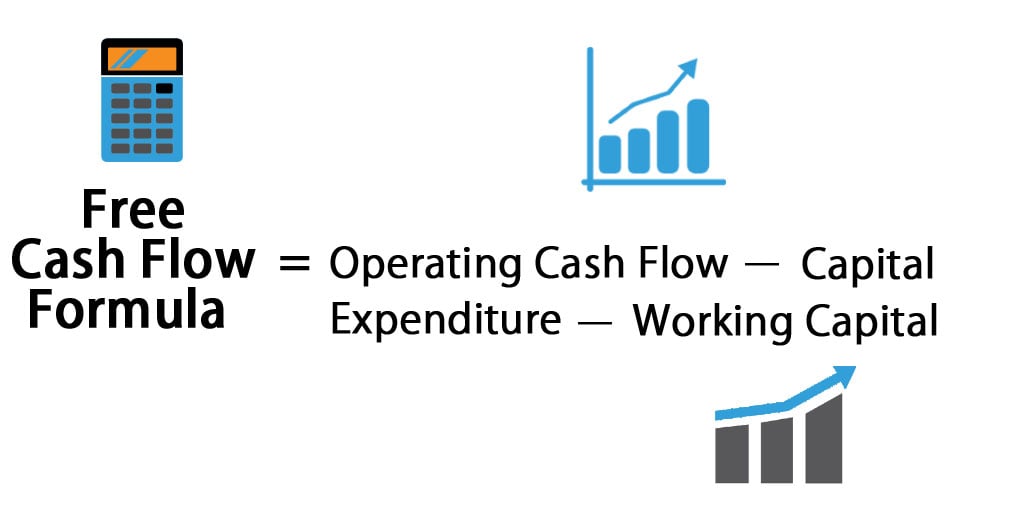

Free Cash Flow Fcf Definition

Without a cash flow statement, it may be difficult to have an accurate picture of a company’s performance.

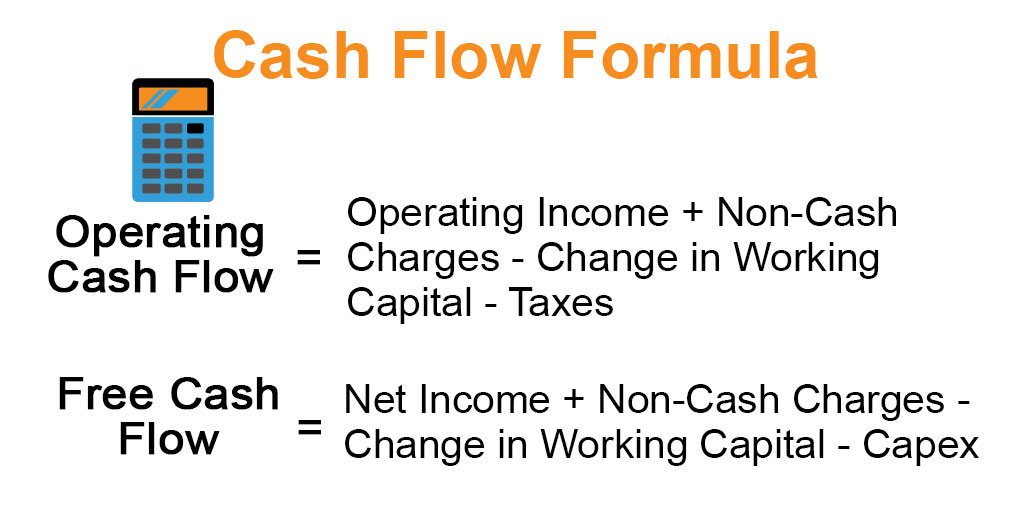

Operating cash flow ratio importance. Price to cash flow ratio is a valuation ratio which attempts to value a stock based on net cash flows from operating activities that it generates. Operating cash flow (ocf) is one of the most important numbers in a company’s accounts. This is the net figure provided by the cash flow statement after taking into consideration adjustments for noncash items and changes in working capital.

This paper analyzes the use of cash flows ratios as a measure of performance in emerging economics by assessing the cash flow ratios relate with the financial performance indices. An emerging economy is seen as one that has been or is in the process of globalizing (pereiro, 2002). Ljj found that cash flow from operations is significant in explaining changes in the current ratio and cash conversion cycle but it is not significant in explaining changes in quick ratio.

The cash flow coverage ratio is a good general evaluation metric, but it can also be particularly important for businesses such as hospitals and medical practices. It should be considered together with other liquidity ratios such as current ratio, quick ratio, cash ratio, etc. Operating cash flow is an important benchmark to determine the financial success of a company's core business activities as it measures the amount of cash generated by a.

This ratio indicates the ability of a company to translate its sales into cash. They are an essential element of any analysis that seeks to understand the liquidity of a. It helps to understand the capability of a firm to cover its current liabilities.

Operating cash flow (ocf) ratio. 1.1.1 importance of cash flow ratios 16 1.1.2 use of cash flow ratios as a predictor to failing business 20 1.1.3 relative performance evaluation using ratios 24 1.1.4 accounting for and reporting cash flows 25 1.1.5 financial statements information and the role of cash flow statement 26 Operating cash flow is intensely scrutinized by investors, as it provides.

It reflects the amount of cash that a business produces solely from its core business operations. This ratio is generally accepted as being more reliable than the price/earnings ratio, as it is harder for false internal adjustments to be made. Cash flow ratios compare cash flows to other elements of an entity’s financial statements.

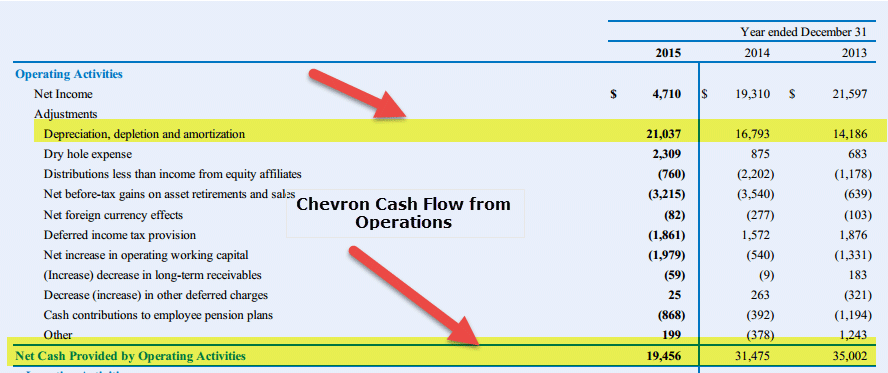

The cash flow statement is the financial statement that presents the cash inflows and outflows of a business during a given period of time. For example, if a company seals a large sale deal, it will boost its revenue. Operating cash flow is an essential part of a cash flow statement as it gives a transparent financial view of the current business operations.

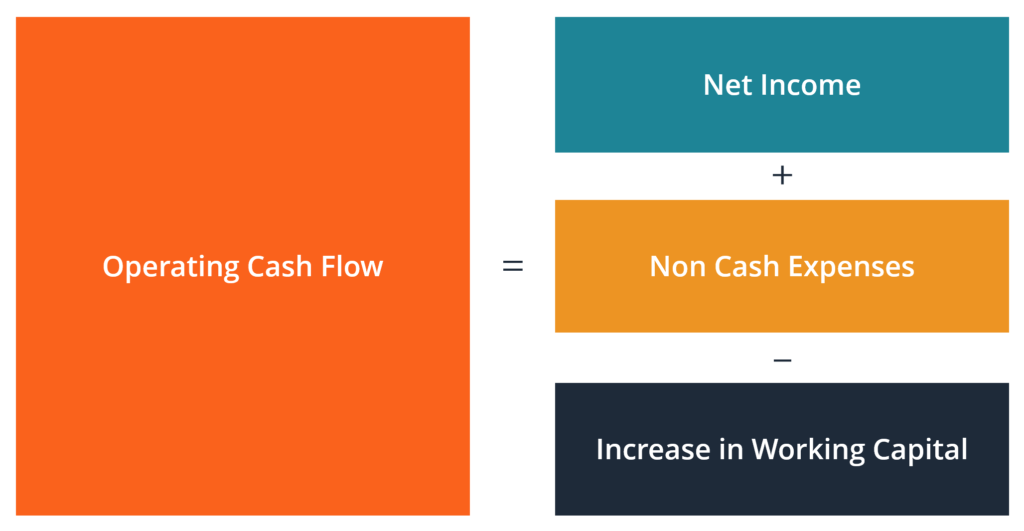

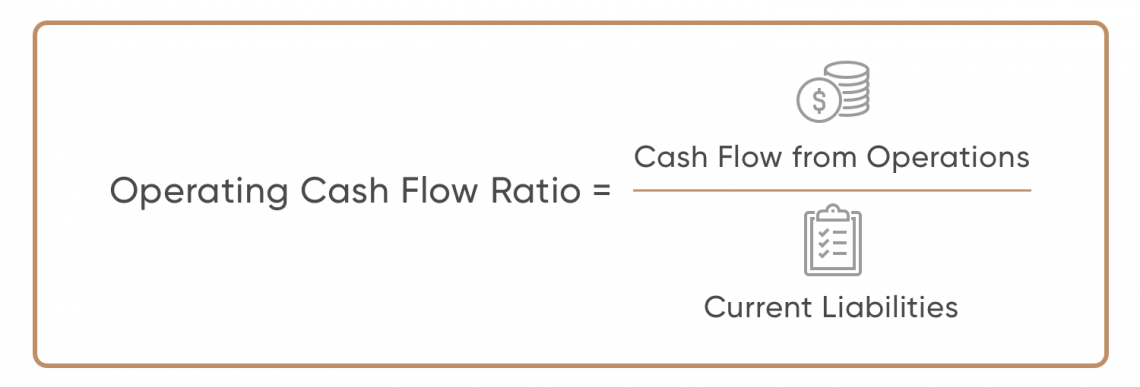

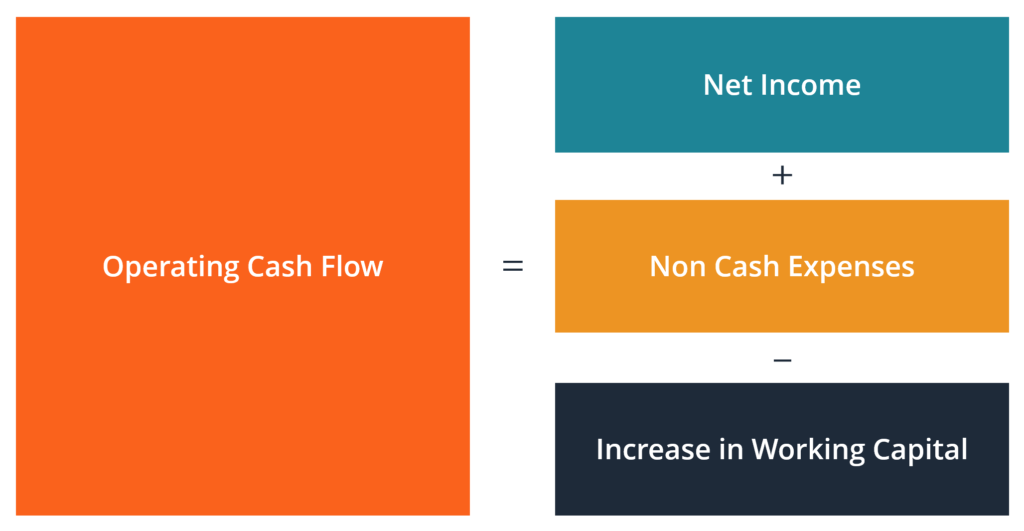

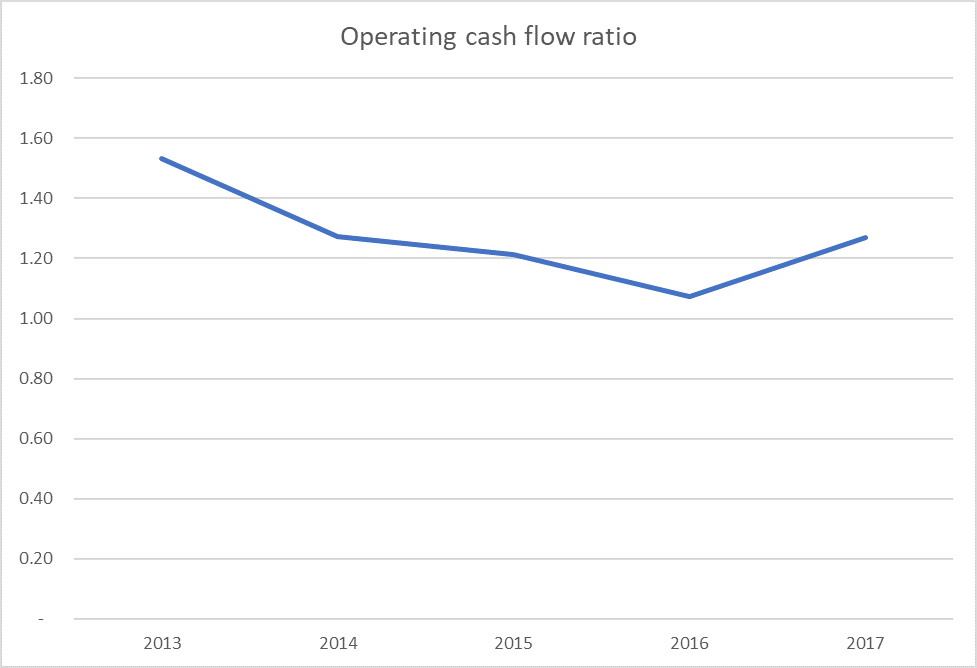

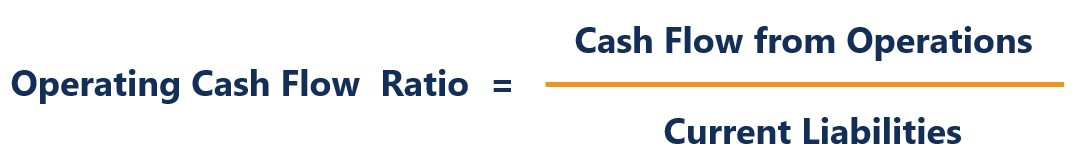

Operating cash flow ratio measures adequancy of cash flows from operations in a given year with reference to current liabilities. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a company's operations. The numerator of the ocf ratio consists of net cash provided by operating activities.

While net income shows if the company is keeping its head above water for now, its operating cash flow shows if it's actually making money—and few investors want to put their money down on a business that doesn't generate cash. For example, your operating cash flow ratio indicates the number of times that you can pay off your current debts with cash generated from your business. Operating cash flow ratio is an important measure of a company’s liquidity i.e.

It is equally as important as the income statement and balance sheet for cash flow analysis. Calculation (formula) the formula for this ratio is simple. Importance of operating cash flow.

As such, it is a good tool for lenders and creditors, especially when evaluating smaller or new borrowers. Operating cash flow / sales ratio = operating cash flows / sales revenue x 100%. This ratio can be calculated from the following formula:

The operating cash flow ratio measures the funds generated and used by the core operations of a business. Therefore, cash is just as important as sales and profits. For example, the use of the operating cash flow operating cash flow operating cash flow (ocf) is the amount of cash generated by the regular operating activities of a business in a specific time period.

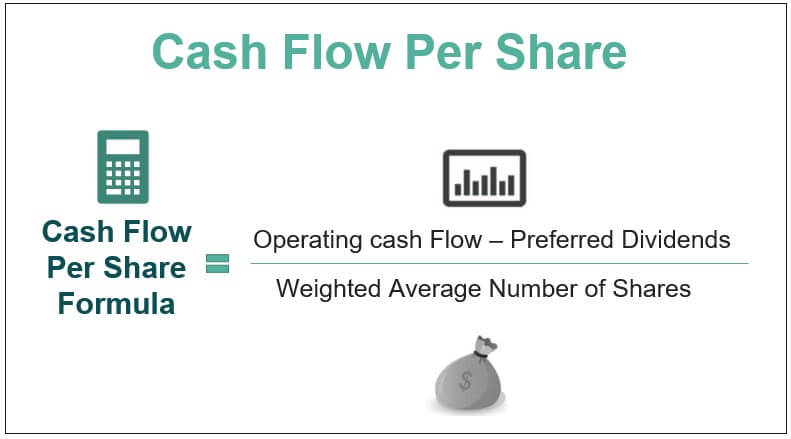

It measures the amount of operating cash flow generated per share of stock. Essentially, operating cash flow ratio or cash flow from operations is a liquidity ratio. However, if the company is not able to collect the money, then it is not positively.

Operating Cash Flow Ratio Definition And Meaning Capitalcom

Operating Cash Flow - Definition Formula And Examples

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Definition Formula Example

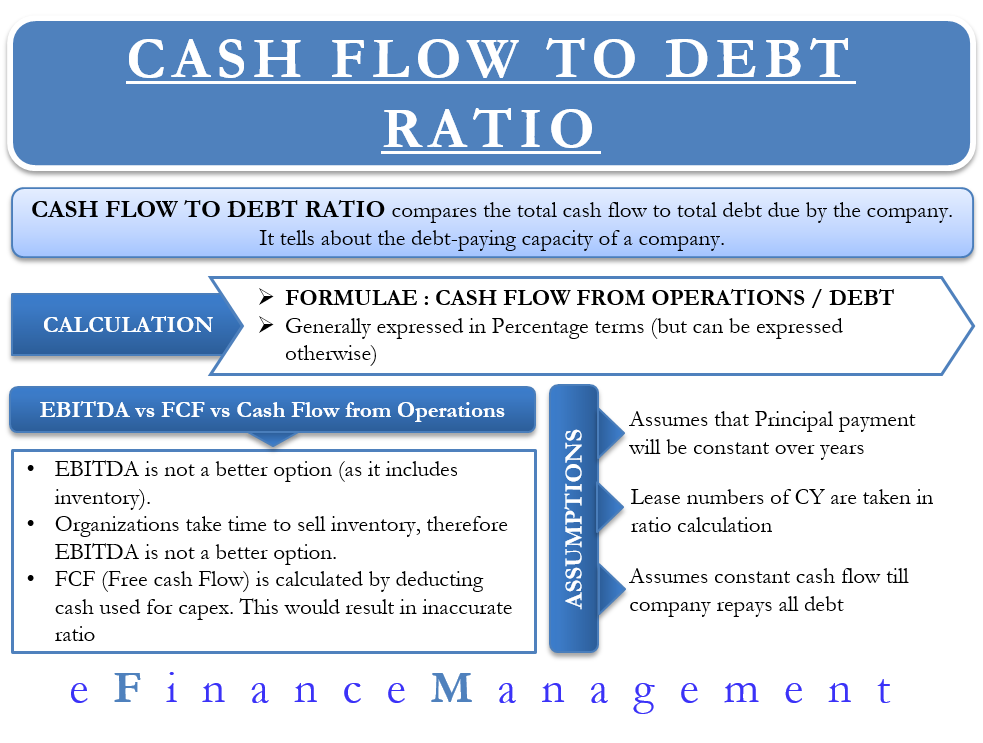

Cash Flow To Debt Ratio - How To Assess Debt Coverage Ability

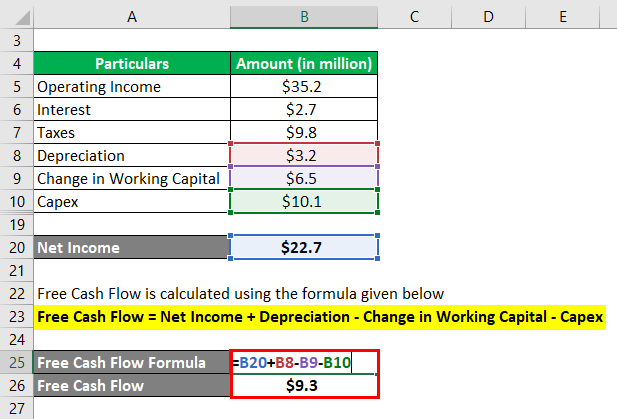

Free Cash Flow - Efinancemanagement

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Formula Example Calculate Pcf Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Formula Example Calculate Pcf Ratio

Fcf Formula - Formula For Free Cash Flow Examples And Guide

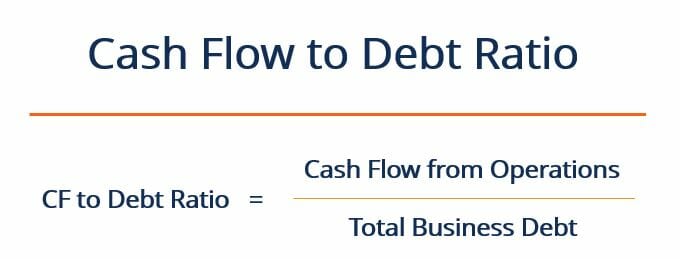

Cash Flow To Debt Ratio Meaning Importance Calculation

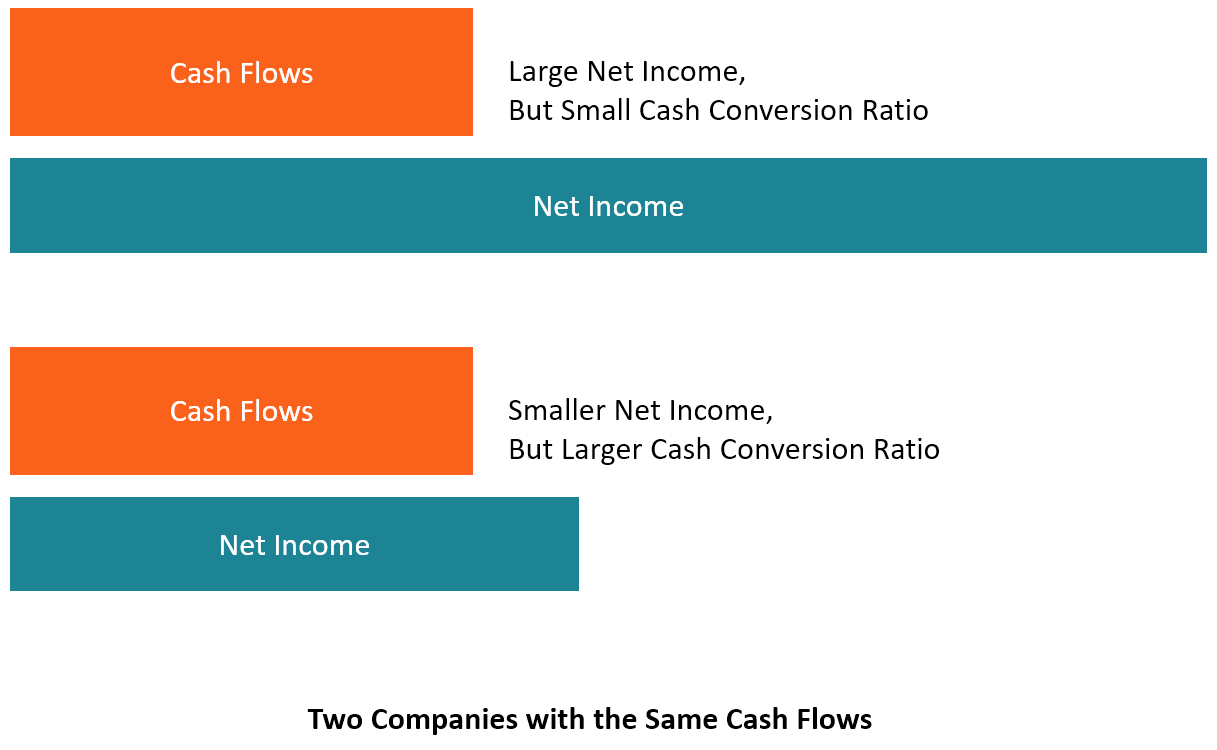

Cash Conversion Ratio - Comparing Cash Flow Vs Profit Of A Business

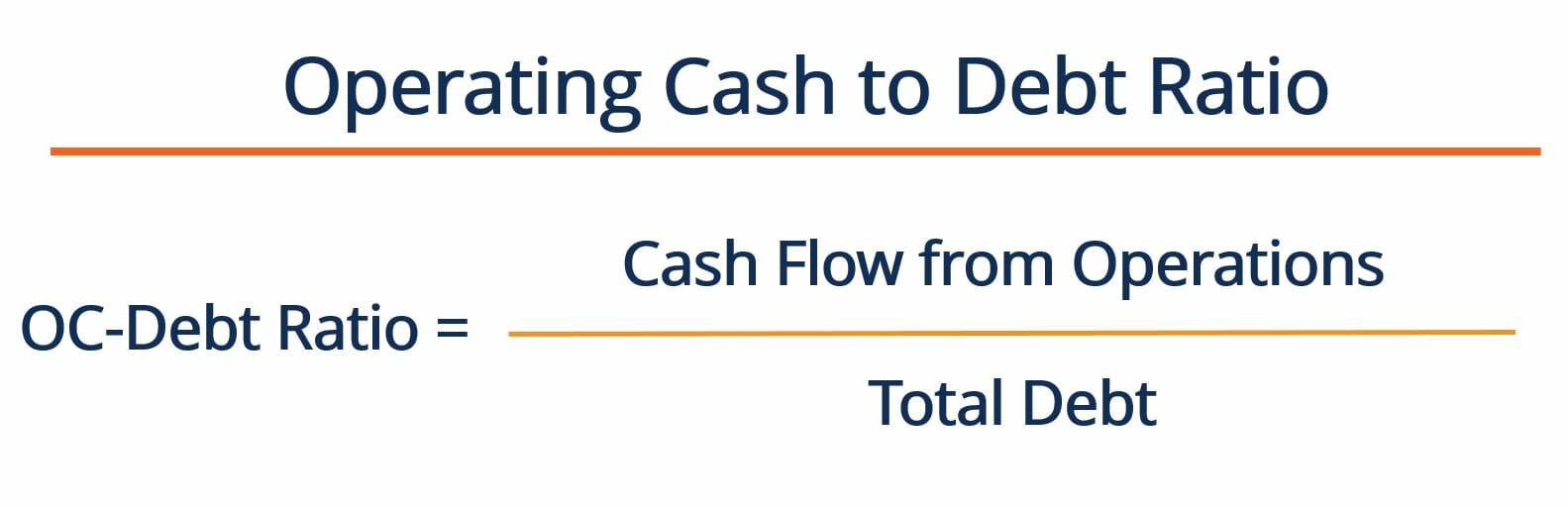

Operating Cash To Debt Ratio Definition And Example - Corporate Finance Institute

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

Operating Cash Flow Ratio - Formula Guide For Financial Analysts

Operating Cash Flow Ratio Definition And Meaning Capitalcom

Free Cash Flow Formula Calculator Excel Template

What Is Free Cash Flow And Why Is It Important Example And Formula Quickbooks